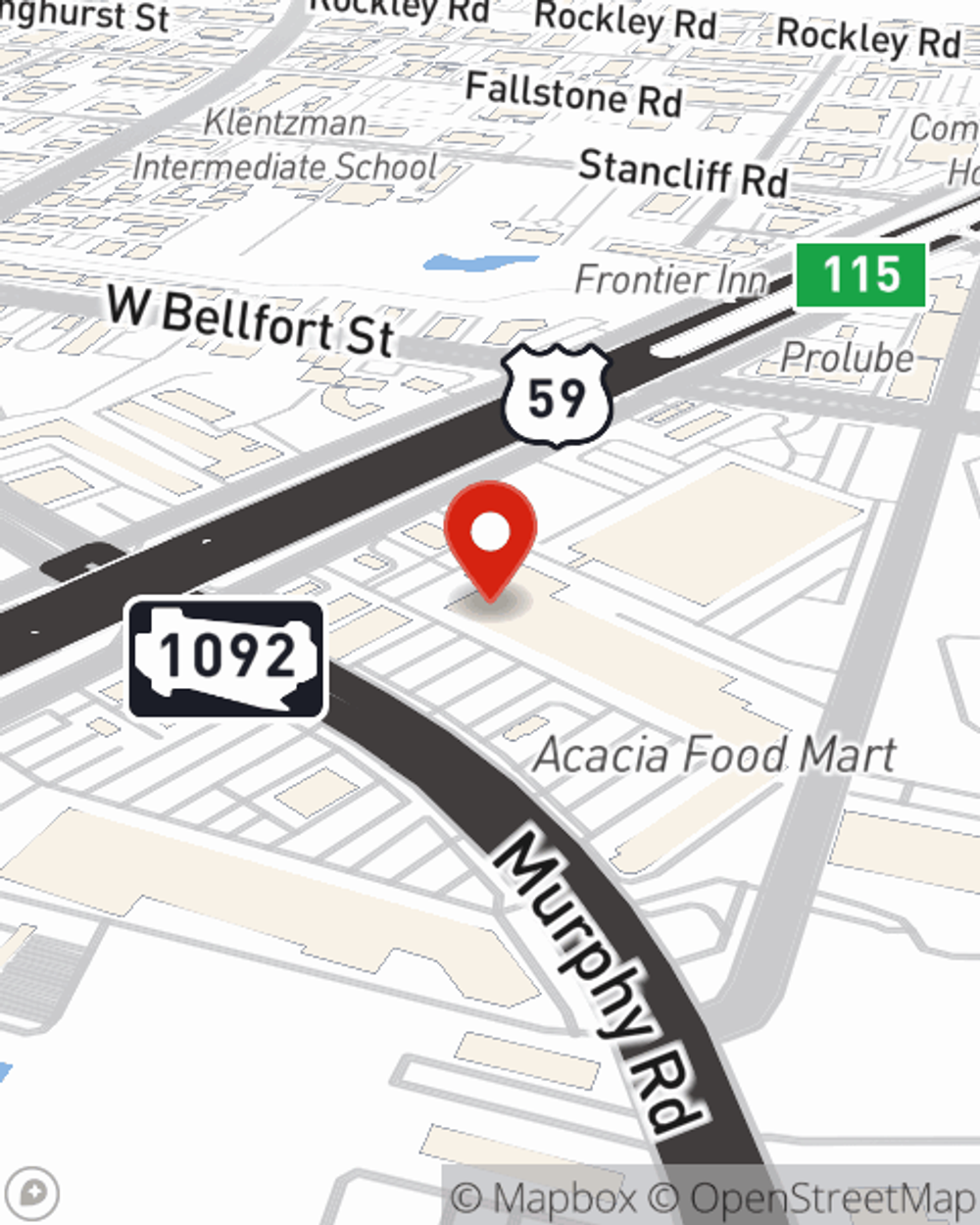

Life Insurance in and around HOUSTON

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- HOUSTON

- Katy

- Missouri City

- Sugarland

- Humble

- Cypress

- Southwest Houston

- Pasadena

- Pearland

- Spring

- Fresno

- Bay City

- League City

- Jacinto City

- Rosenberg

- Friendswood

- Galveston

State Farm Offers Life Insurance Options, Too

When it comes to dependable life insurance, you have plenty of choices. Evaluating providers, coverage options, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Peter Mugo is a person with a true desire to help you create a policy for your specific situation. You’ll have a hassle-free experience to get reasonably priced coverage for all your life insurance needs.

Get insured for what matters to you

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

When applying for how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like your current age, how healthy you are, and perhaps even occupation and body weight. With State Farm agent Peter Mugo, you can be sure to get personalized service depending on your particular situation and needs.

It's always a good idea to make sure your loved ones have coverage against the unexpected. Reach out to Peter Mugo's office to learn more about your Life insurance options with State Farm.

Have More Questions About Life Insurance?

Call Peter at (281) 498-2553 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.